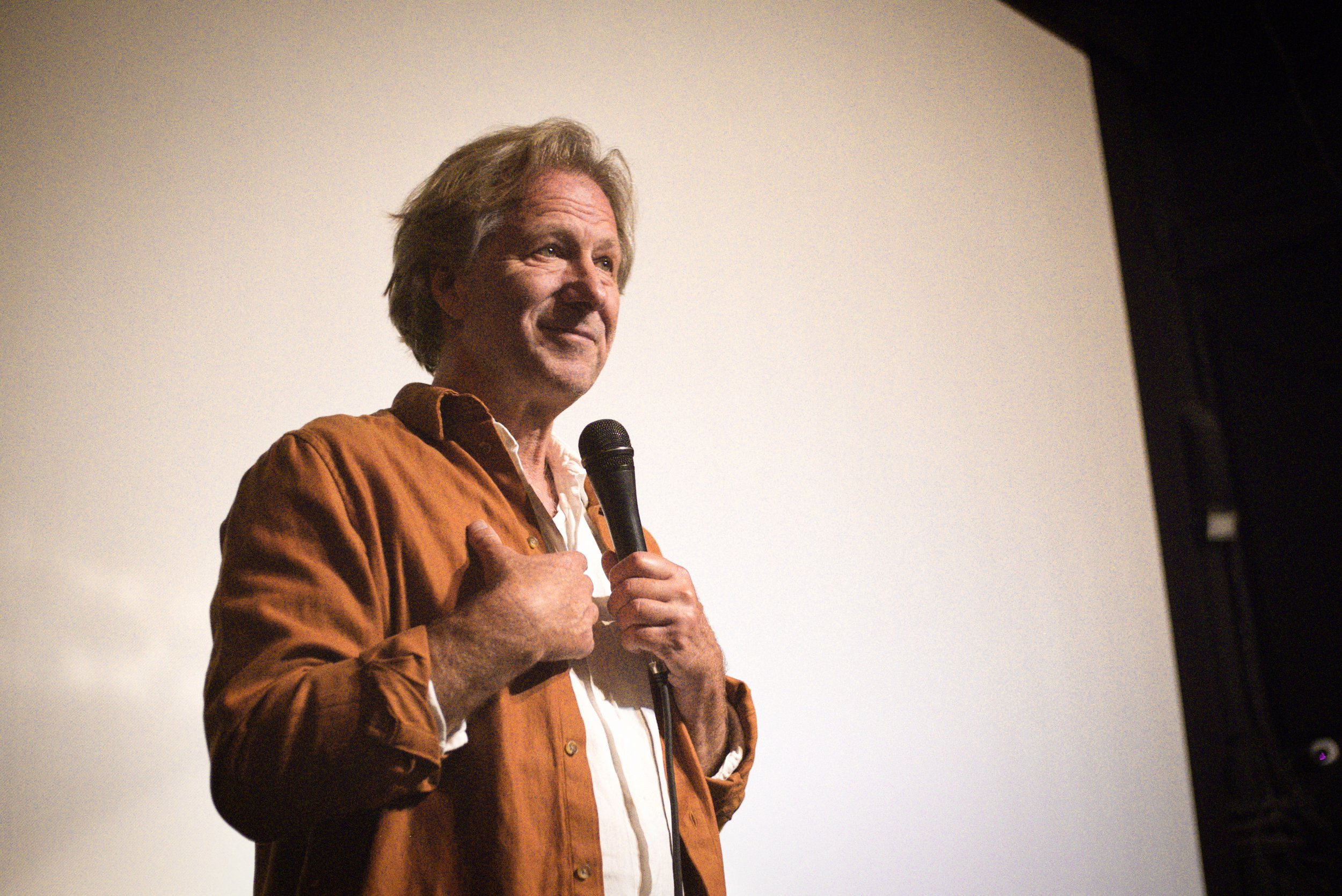

A translation of a story from Swedish daily Sydsvenska Dagbladet.

Will Oatly really be able to turn bad money into good, and save the climate at the same time? Fredrik Gertten paints the picture of the American private equity fund Blackstone, which has invested 200 million USD in the oat milk start up Oatly, based in Malmö Sweden.

Do you want to see more poor people evicted from their homes? Then ask to have your cappuccino heart made from Oatly milk! Is that an unfair claim? I know that my friends at Oatly in Malmö think so.

Just because the American hedge fund Blackstone bought into their company does not mean that the content of the good oat product changes, right? It did not do so even when a company linked to the Chinese state became a major shareholder.

I have been proud that Oatly comes from Malmö. When our company WG Film was sued by Dole for the film Bananas!* In 2009, I was contacted by Oatly's CEO Toni Petersson. He was inspired by how we published Dole's accusations against us on our website side by side with our own arguments, a model that Oatly copied when they were sued by Swedish Milk because they called the oat drink “milk” in their marketing.

Tony's commitment to veganism and sustainability was convincing. He recruited young soulful people who were passionate about building a more sustainable world. People who truly wanted to be a part of the change. The small company from Malmö was successful. New markets were opened. Environmentally conscious hipsters in country after country wanted Oatly in their coffee.

But every time a small business grows, more money is needed. That is when the hardships begin. For every new venture capitalist, you lose some of your own influence and identity.

Learn from Hövding, the Malmö company that created the fantastic airbag bicycle helmet. When the venture capitalists became too powerful, the two female founders went out.

The arguments from Oatly (their talking points) are simple: “We get the big capital to finally invest in sustainable and socially conscious enterprises. Is that not what you want, Fredrik? Given the climate, the financial sector should be involved in breaking the structures that stand in the way of a better world ”.

This is what people at Oatly wrote to me on Twitter and Facebook, and it is not a bad argument. After all, is it possible to change the world without the help of the richest people on the planet?

Blackstone is the world's largest private equity fund. Stephen A. Schwarzman, founder and CEO, is a close friend of Donald Trump and was chairman of the president's economic council in 2017. Trump's entire term has been a grand attack on all the values Oatly stands for. Schwarzman himself is worth almost $19 billion, a private fortune that has grown dramatically since the financial crisis of 2008. Then, as well as now, Blackstone was ready with financial muscles to buy up assets that had fallen in value. Suddenly, the fund became, out of nowhere, the largest landlord in the United States, Spain and Ireland - the countries where most homeowners were affected during the financial crisis. A wave of evictions was set in motion.

In the United States, 13 million people lived in homes taken back by the banks. The majority of those who ended up on the streets were African Americans and Latinos. (If you're wondering why people are so angry right now: they've lost everything.)

Nobel laureate Joseph Stiglitz, whom I interviewed for my film "Push," is critical of Blackstone and their lack of morals. "You can make a lot of money destroying the planet, but there's something wrong with that," he says in the film. A fairly simple sentence from a Nobel laureate, it could have been Greta Thunberg.

Blackstone uses its money to influence the policies of many countries. In the United States, they are funding Republican candidates who want to cut taxes for the richest and who want to remove regulations for environmental protection.

A few weeks ago, the young Democrat Alexandria Ocasio-Cortez won the House of Representatives election in her Bronx district. Schwarzman supported her opponent. AOC, as she is called, is passionate about The New Green Deal. With values closely resembling Oatly’s, I believe. Projects that Trump and Blackstone are actively working against.

Oatly's strong environmental argument is that we must eat plant-based food if we are to stop climate change. It is a pity that Blackstone are large investors in the Brazilian soy industry; they are partners in the company that is building the road to a new soy export port in the Amazon, and the port itself. That is why the forest is burning, to make room. The soy is then shipped to China where it is used to feed pigs, chickens and fish in a giant agro-industry. An industry Oatly built its brand on working against.

Oatly defines themselves as one hundred percent good. On the good side in the big battle for a more sustainable world.

The deal with Blackstone was marketed with names like Oprah Winfrey and Natalie Portman becoming co-owners. Their names strengthen Oatly's success story, much cooler than the fact that Starbucks' CEO also bought in on the deal. Still, the Oatly people were prepared to receive criticism for their choice of new co-owners.

This is what Oatly writes to me on Twitter: "By virtue of being a Blackstone investment, we push the leading player in private equity to think about the same things we do and align their goals with our own.”

It sounds like a fairytale: the underdog from Malmö turns the company that the UN believes violates human rights into something good.

Let's pretend this is true. But what if Blackstone instead uses the profits from Oatly and invests heavily in even larger meat factories?

Blackstone does not have a reputation for being a long-term investor. For a few years they were the largest private owners of Swedish suburbs. After raising the rents for the poorest in society by fifty to seventy percent, they sold the whole thing off. They had secured their profit.

On July 1, Denmark got a new law called "Lex Blackstone". The Danish parliament believed that companies like Blackstone were destroying the Danish housing market with their aggressive rent increases and their short-term plans. The law means a five-year rent freeze. All to protect Danish tenants.

Blackstone earned six billion SEK from the Swedish suburbs for five years. Where's that money now? Have they bought more soybean plantations in Brazil? They bought a bank in Holland this week. A few months ago, Blackstone purchased Australia's largest casino busines, shaken by the covid crisis. It was a deal of 500 million dollars, so more than the 200 million dollars that Oatly received.

Blackstone manages assets of around $ 600 billion, they are the world's largest private equity fund - and yet Oatly believes they can influence this giant. Is it possible to believe that Oatly's oat drink makes life better for those who have been forced to leave their homes in Blackstone's renovictions, when they renovate in a way that makes the tenant unable to afford to move back?

If Blackstone earns their money by demolishing, do you want their money to rebuild? Where do you draw the line, Oatly? When is the money too dirty?

Can you talk about a sustainable world without talking about social sustainability? Can you sell your soul and still keep it?

Director Fredrik Gertten questions our choice to let the capital giant Blackstone enter as a minority owner in Oatly. He believes that we sold our souls to a company that through its various companies has done everything from deforestation to human rights abuses. I am convinced that Fredrik Gertten through his work wants to create change for real. Just like us. The only question is how the change will go. The starting point is that we, like most other growth companies, need money to be able to continue to grow. "For every new venture capitalist, you lose some of your own influence and your identity," writes Fredrik. Is it true? For some maybe, but not for us. I want to say that we have at least as much influence as when I joined this company eight years ago and our identity is stronger than ever. Our owners realize that the best way they can manage their investment is to let us do exactly what we already do and continue to be what we have always been. Everything else would be to throw the money into the sea, and I do not think a company like Blackstone wants that either. A little later in the article, Fredrik Gertten approaches the key question: "Is it possible to change the world without the help of the planet's richest?" As we see it: No. Not when we are trying to tackle something as big and acute as the climate crisis. How would that work? Should we get people to boycott the companies that control the world's capital flows? Difficult, if not impossible. Most people have their pensions invested in these companies' funds (consciously or unconsciously) and when it comes to the pension in particular, you often stand closest to yourself and are happy with every penny that falls into the account. Should we get states and governments to create stricter regulations? Possible, but it's way too slow. And the climate can not really wait, no matter how cliché it sounds. A third alternative is to get the fighting streams of capital invested in different companies to end up in sustainable companies. For example, by, like Oatly, choosing to receive money from a company like Blackstone in front of a company that already manages green money today. The deal we just completed means that we are moving at least a few dollars in the right direction (200 million to be exact), dollars that would otherwise have gone to something else. This is how real change is created. And this is exactly what Oatly's DNA is: To constantly question the status quo, to challenge and dare to make uncomfortable decisions to push the world in the right direction. Because this is rubbing, there is no doubt about that. Fredrik Gertten believes that it is pure poetry when we try to explain that we actually have the opportunity to influence the world's largest private equity fund. But what if, ironically, he has already done the job himself? Imagine if Fredrik Gertten, through his film "Push" (see it if you have not already done so), paved the way for this deal. That it is his documentary that made Blackstone reflect that sustainable investment may be the future, both from a humanistic and economic perspective. Yes, then we have both, in different directions, managed to create change. Albeit for one party in an unexpected (and perhaps undesirable) way. We have also started a vital debate on how we can deal with the climate crisis, where everyone must take responsibility and help - companies, governments and ourselves as individuals. Not to mention those who sit on capital. Has this been an easy decision? No, certainly not. But I am convinced that this is the right way to go. Fredrik Gertten's concluding question "Can you sell your soul and still keep it?" therefore gets the answer: Probably not. But we have not sold our soul. It is just the opposite: by making the uncomfortable decision to sell a minority stake to one of the world's largest private equity funds, we are loyal to ourselves.

Why is the Amazon burning? Why are tenants all over the world being pushed out into the streets, Toni? Because of a business model that consistently puts profit before morality. There is an sometimes successful movement for ethical investments around the world. Against the arms industry, environmental degradation, oil and coal, against companies that violate human rights. Half of all money on the world's stock exchanges comes from pension funds. Can we get them to opt out of immoral actors like Blackstone so real change can be created? Oatly chooses to greenwash an actor with a well-documented history of immorality. Turns its back to a progressive movement. Is there no dirty money? Where do you draw the line? Refugee smugglers, cocaine traffickers, governments who commits genocide, companies that don’t respect human rights. I think you have to decide. You and I Toni, in all respects. I'm a little shit, own nothing. Has my movie "Push" affected Blackstone? Maybe, it has at least made them write harsh letters of complaint to TV companies in France, Germany and Sweden. Also to the Swedish Parliament and the Swedish Consulate in New York. Blackstone refused to meet UN's Leilani Farha, time after time. Dialogue is not their style. Perhaps Oatly's identity and soul were lost a long time ago. It is not radical and challenging to receive money from China or a giant private equity fund. It’s a conventional way of growing. Oatly's owners want rapid growth. Soon they can buy their first yacht. Meanwhile, the Amazon is on fire.

PS. I hereby invite you to a public conversation with Oatly and the UN's Leilani Farha. We can watch "Push" together and talk about how to change the world.